Trump’s “Liberation Day” and the New Economic Doctrine of America First

On April 2, 2025, President Donald J. Trump stood at the White House and declared what he called the “Declaration of Economic Independence.” Backed by sweeping policy changes, he unveiled a 10% universal tariff on all imports, along with country-specific penalties designed to target nations he says have long taken advantage of the United States (Executive Order).

To supporters, this marks the dawn of a new economic era—a recalibration of global trade in favor of American workers. To critics, it’s a risky experiment that could spark recession, fuel inflation, and strain international alliances.

For over 20 years, since China’s entry into the World Trade Organization in 2000, Americans were promised that globalization and cheap imports would lead to rising prosperity. We were told that lower prices at Walmart would make everyone better off. But did it?

The real test is: what happens to real wages?

Last time Trump implemented a tariff-focused strategy, real wages rose by $6,500 over three years — before COVID derailed the global economy. That’s a far cry from the $5.50-a-year “gain” under Bush and Obama.

He believes — and his supporters agree — that the real trade war was already happening. America was just the only one not fighting back. What’s clear is this: Trump isn’t just rewriting trade policy. He’s attempting to redefine the very terms of U.S. engagement with the global economy.

The Policy: A “Reciprocal Tariff” Doctrine

President Trump’s doctrine is rooted in reciprocity and economic self-defense: If another country disadvantages American exports, the U.S. will respond in kind.

Core Elements of the Doctrine

1). 10% Universal Baseline Tariff

Effective April 5, all imports to the U.S. face a flat 10% tariff. This across-the-board measure is designed to:

- Promote domestic manufacturing

- Reduce reliance on foreign supply chains

- Restore “fairness” in global trade

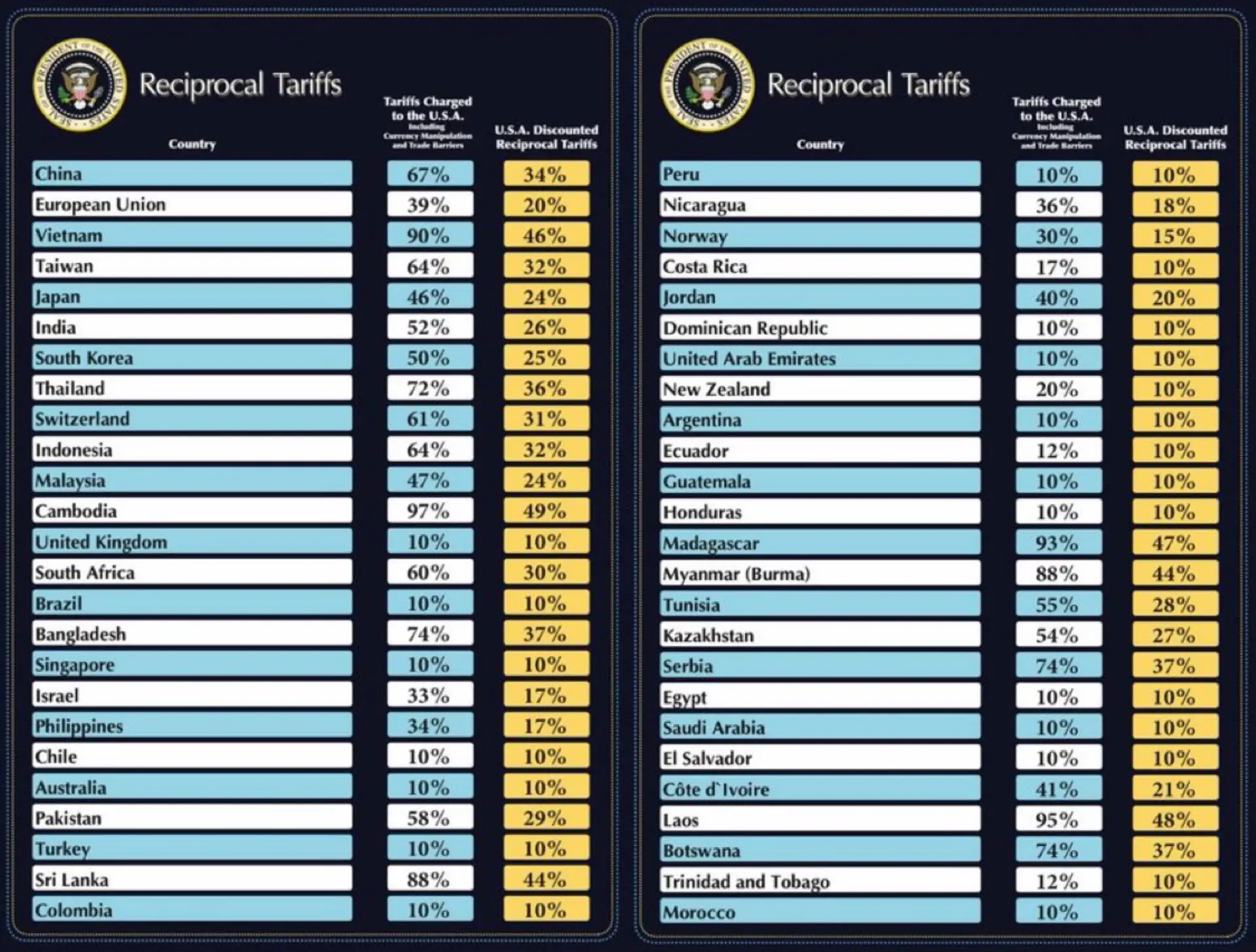

2). Nation-Specific Reciprocal Tariffs

Beginning April 9, countries with tariffs, subsidies, or currency manipulation practices that harm U.S. trade interests face additional penalties, calculated to offset half the estimated damage to the U.S.

Examples include:

- China: +34% → 54% total

- Vietnam: 46%

- Japan: 24%

- India: 26%

- Taiwan: 32%

- European Union: 20%

Even allies like Australia and Israel are included if data shows a trade imbalance.

3). Strategic Exceptions & Penalties

- Canada and Mexico are exempt from the full reciprocal model but face 25% targeted tariffs on certain imports tied to fentanyl trafficking and immigration concerns.

- A 25% tariff on all foreign-made automobiles takes effect immediately, aiming to restore American dominance in auto manufacturing.

The Rationale: National Security Meets Economic Fairness

Trump argued that trade is no longer just an economic issue—it’s a national security imperative.

“Trade deficits are no longer merely an economic problem. They’re a national emergency.”

The logic aligns with Trump’s long-standing “economic nationalism”:

- Sovereignty starts with economic autonomy

- Reshoring manufacturing is essential

- Industrial independence protects national interests

Supporting Data Points:

- The U.S. has lost over 60,000 factories since NAFTA

- Chinese IP theft costs the U.S. $225–$600 billion annually

- The U.S. cannot produce enough antibiotics for its population

- China builds more ships annually than all U.S. shipyards combined

Results Already Underway: Trillions in New Investment

Trump didn’t just deliver rhetoric—he showcased results.

Major companies including Apple, Nvidia, SoftBank, Oracle, TSMC, Eli Lilly, Meta, and GE Aerospace have committed over $6 trillion in U.S.-based manufacturing investments.

“These companies aren’t just building factories—they’re building the future of America.”

—President Trump

This echoes the blue-collar boom of Trump’s first term (2017–2020), which saw nearly 500,000 new manufacturing jobs and a reversal of offshoring trends under NAFTA and TPP.

Strategic Logic: Economic Leverage as Foreign Policy Tool

Treasury Secretary Scott Bessent called the tariffs a “high-water mark” and emphasized that countries willing to reduce their own trade barriers could avoid further penalties.

Already, countries like Israel and Vietnam have shown openness to negotiation. Canada’s Doug Ford has indicated a willingness to cooperate. The tariffs, controversial as they are, seem to be functioning as intended: a negotiation tool disguised as economic warfare.

Critics Push Back: Legal, Economic, and Political Concerns

Opposition spans the ideological spectrum.

Legal/Constitutional

Senators Tim Kaine (D-VA) and Rand Paul (R-KY) introduced a resolution arguing that Congress, not the President, has the constitutional authority to impose taxes.

Economic

Economists warn of:

- $5,000+ in extra costs for American families

- Inflationary pressures

- Risk of global retaliation

Political

Democrats labeled the day “Recession Day”, accusing Trump of courting chaos for electoral gain. Still, some centrists agree on the need for economic sovereignty, even if they disagree on the means.

Reinforcing the America First Policy Agenda

Trump’s announcement aligns closely with the America First Policy Institute’s trade blueprint:

- Use tariffs to counter unfair practices

- Enforce U.S. trade laws (e.g., Section 301, Section 232)

- Renegotiate trade agreements (as done with USMCA, Japan, China Phase One)

- Demand accountability from global institutions like the WTO

Global Reaction & Market Volatility

Markets reacted swiftly:

- S&P 500 and NASDAQ fell 1.5%–2.5%

- Companies like Apple, Amazon, and Nike—heavily reliant on global supply chains—dropped 6%+ in after-hours trading

Trump’s response?

“If companies want zero tariffs, build in America. If countries want access to our market, they must lower barriers and buy American. It’s that simple.”

Economic Outlook: Short-Term Pain, Long-Term Strategy?

While markets remain nervous, the White House insists that early volatility is a necessary reset. They point to $3 trillion in U.S. manufacturing commitments since Trump returned to office.

Tariffs are just the start.

Tax Reform Package Highlights:

- No tax on tips, overtime, or Social Security

- Deductions for American-made vehicle purchases

- Corporate tax cuts to incentivize domestic production

“It’s the two T’s: Tariffs and Tax Cuts,” said Bessent. “Two sides of the same coin: a stronger American economy.”

Big Picture: The End of Economic Liberalism?

Trump’s tariff doctrine marks a strategic break from decades of U.S. policy grounded in globalism, free trade, and multilateralism. In its place: a transactional, nationalistic economic model focused on reshoring, rebuilding, and rewarding American labor.

To supporters: a rebirth of blue-collar pride and industrial sovereignty

To detractors: a dangerous retreat that risks isolationism, higher prices, and geopolitical instability

Final Thought

“Liberation Day” represents more than a policy shift. It is a bold wager on the American worker—and a declaration that the U.S. will no longer bankroll globalization at its own expense.

Whether this strategy succeeds—or exacts too steep a cost—will shape the 2026 midterms, the global economy, and the future of American leadership.

Trump’s phone may be “ringing off the hook” from foreign leaders asking for exemptions. But as one senior official put it bluntly: “Don’t expect President Trump to blink.”

Stay Ahead with Pacific Square!

Learn more about how Pacific Square can help you expand globally with clarity, confidence, and strategic precision.

Contact us today for tailored solutions that address your business’s unique needs and discover how we can elevate your operations to the next level.

Pacific Square will continue tracking these developments across manufacturing, technology, consumer markets, and international relations.

If you’re a policymaker, business leader, or investor navigating the post-globalization economy, stay tuned. 🔔 Subscribe for future analysis.